The dark side of the business model canvas

No doubt, the business model canvas has improved the way we describe business models nowadays. After my first interaction with it – August 2010 at Haas Business School in California – I have created dozens of them myself and have facilitated as well as provided feedback on hundreds of them in my role as coach and mentor at diverse early stage startup events. You can check out my business modeling presentation at the Munich Startup Accelerator to learn about some good practices and workarounds using the canvas. I feel like it is time now to reflect a bit broader on my overall experience with the business modeling canvas.

As the advantages are discussed and highlighted frequently, I would like to focus on areas of improvement in this post. The following posts will deal with my experience with the Lean Canvas and finally my personal point of view on how a business model depiction should look like structurally and content wise.

Breadth over focus

I can’t count the number of sessions where teams collaborated heavily – which is really good – but finally ended up with a messy canvas as everybody wanted to contribute something. Typically, no direct follow-up happens where the team decides by either further analysis or a gut feel voting what should stand out per category – in other words: what to focus on. This leaves the Business Model Canvas exercise to a pure brainstorming activity with limited value. One important follow-up task that I recommend is to decompose the messy canvas in several models that have coherent aspects. Assume e.g. 7 customer segments. I recommend to document only the 2 most important segments in a multi-sided platform model – e.g. 1 key user, 1 key customer – to keep the focus and not pollute the overview. However, it still makes sense to capture the other segments and related components in separate models. Same for multiple value proposition or product/service ideas.

Created once, rarely updated

With analysis or without analysis directly after the session, the canvas rarely gets revisited or updated after the initial creation – at least when having used the paper canvas. Not sure about digital versions. Again, this basically means that the canvas is a one-off tool rather than a strategic tool to guide the mission. I feel that most entrepreneurs think that there is not enough value in updating a strategic view in comparison to some tactical actions. Especially in case it is the messy view as described above.

Purpose versus value

I found two typical patterns when it comes to the Value Proposition component of the canvas. Either teams solely describe the actual value proposition with “marketing statements”: e.g. “free internet & video calling” or they describe what they actually do/offer. While the first one is certainly the right one when asked about the message to a certain Customer Segment, I still would also like to know and document what the startup is actually providing: a turn-key platform? An API for others to build on? A mobile App (only)? This is currently not in scope and something that I think should be captured as well. Even on the strategic level.

Brevity over clarity

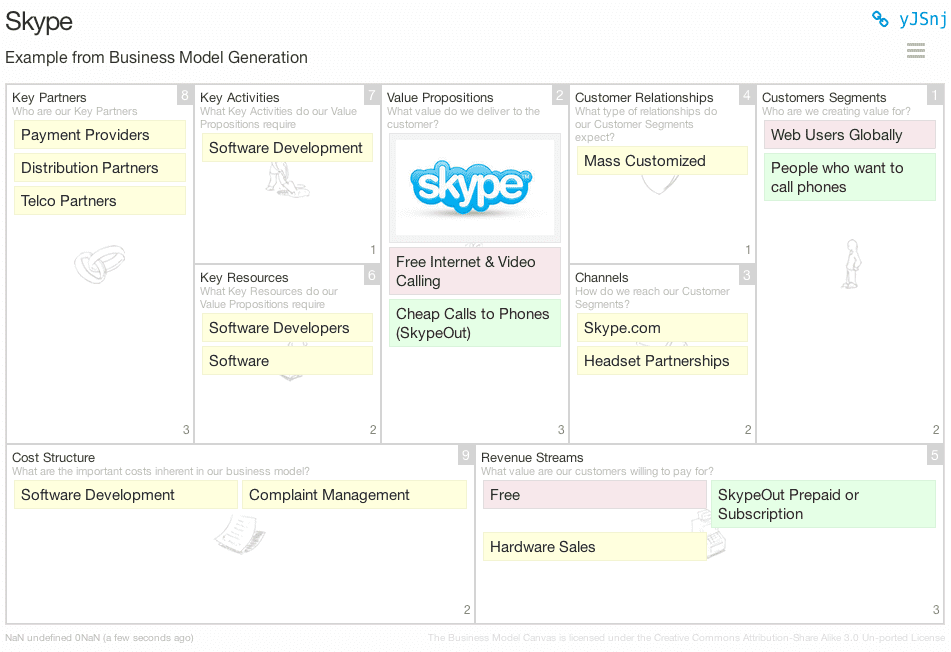

This finding is mainly related to the “published” canvas versions that you can find in the web or in books. They look very tidy and are optimized for a nice first impression. “Great, I got x’s business model in 10 seconds!”. Well, yes and no. While I see real value in a one-pager summary of a business model, I feel like these “perfect examples” based on the Business Model Canvas structure just don’t tell more than a highly superficial story of a certain case. Think the Skype Business Model Canvas in the book, for example:

I don’t want to discuss the whole model but rather give you some food for thought. Key Activites: Software Development. Given the network effect nature of the model, I doubt that Software Development is the single key activity here. The crucial part is rather how to get a critical mass on the platform so that one can actually deliver the value proposition (Marketing). Key Resources: I am quite ok with the mentioned key items but shouldn’t it be a bit more specific? What about “Highly scalable software”? Customer Relationships: Mass Customized. Again, from an early stage perspective, the overall model is missing several crucial components in my view: market, market (entry) strategy, key metrics and unfair advantage. Which market are we after and how big is it? Is it growing? With which strategy are you planning to conquer the market? What metrics are important in this model and/or industry? This can have a tremendous impact on your overall approach, financials, funding choice, etc. Why do you think you can implement that business model best? I am not sure whether the mentioned resources, activities and partners are an answer to that. I certainly understand that one needs to differentiate between a startup’s approach to a new, untested business model and an as-is capture of a matured company’s business model. Nevertheless, as soon as one is drafting the to-be business model, those missing pieces don’t allow you to paint the full picture in my view.

As briefly mentioned in the beginning, in the next post I will share my view on the Lean Canvas and follow-up with my point-of-view on a holistic business model depiction. In the meantime, I would love to get your feedback on your experiences with business modeling and the canvas.

Recent comments